Sales Tax Charge in Pakistan

Sales Tax is an indirect tax; also known as Value Added Tax (VAT). VAT is charged and collected by manufacturer from distributers who keep on passing this to retailers.

Similarly, retailers pass this on to buyer in the chain down below. Ultimately, the end user has to bear the burden of sales tax. The reason is that the end buyer does not sell the product or service rather he consumes it himself.

As per law, a person who has a valid Sales Tax Number is authorized to charge sales tax on sale of goods or service as per prescribed rates.

He must collect VAT from buyer of goods or services and deposit the collected tax into Government treasury in a prescribed timeframe.

A person, not registered for VAT, cannot legally charge sales tax on sale of taxable goods or services.

However, many unregistered persons and business, have been found charging this tax from public abusing the FBR system.

Rates of Sales Tax

Standard rate of sales tax is 17% on goods in Pakistan. Sales tax on services is provincial domain. Rate varies from province to province from 13 percent to 16 percent on standard services. However, sales tax rate varies on specified services.

Charging Further Tax in addition to Sales Tax

It is pertinent to mention that a registered person is obliged to collect three percent additional to seventeen percent if the buyer is not registered for sales tax. Hence, unregistered person has to pay twenty percent sales tax on purchase of goods. This 3% tax is called Further Tax in legal language. This is sort of penalty, raising cost of doing business, thereby forcing unregistered persons to register for sales tax. One of the major object of Further Tax is to document the economy.

How to Check the Abuse

You should check the sale invoice carefully to know whether or not the seller is authorized to charge sales tax. You should see three things on the invoice.

Firstly, Sales tax invoice should carry printed Sales Tax Number of the seller/business. Sales Tax Number commonly known as STRN or GST No. is a numeric number consisting of thirteen digits. Remember National Tax Number (NTN) is not an alternate of STRN.

Secondly, it should have invoice Number.

Thirdly, amount of sales tax should be mentioned separately from the price of goods or service.

If both Sales Tax Number and Invoice No. are in order as explained above, you should take the next step to verify the authenticity of sales tax invoice itself. You can readily verify the authenticity of seller’s registration from FBR website.

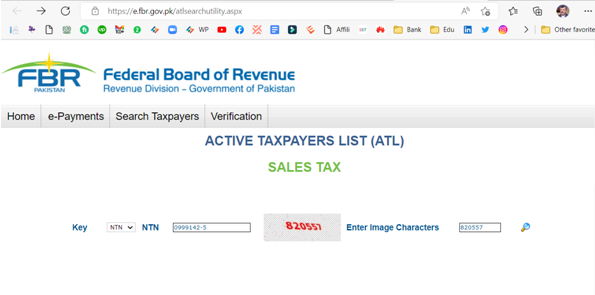

You should go open FBR website Active Taxpayer List (ATL) (fbr.gov.pk), against word “Key” select NTN, write NTN given on the invoice, enter image characters and press search icon (See image-1).

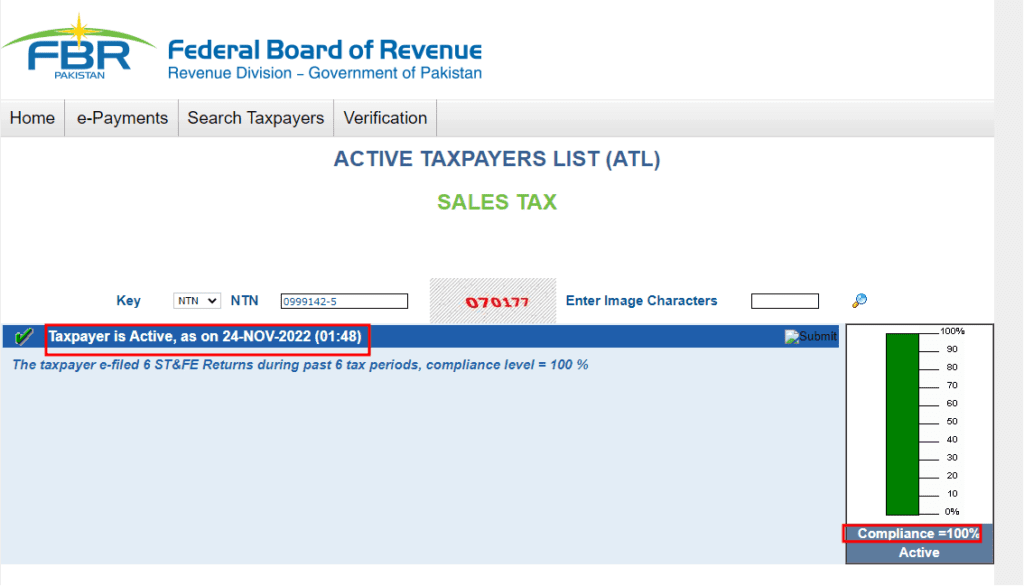

On pressing search icon, a new screen shall display. This would display whether or not the seller is registered (See image-2). In case the seller is registered and has filed sales tax returns during past six months his compliance level would also be visible through a graph on right side of the screen (See Image -3).

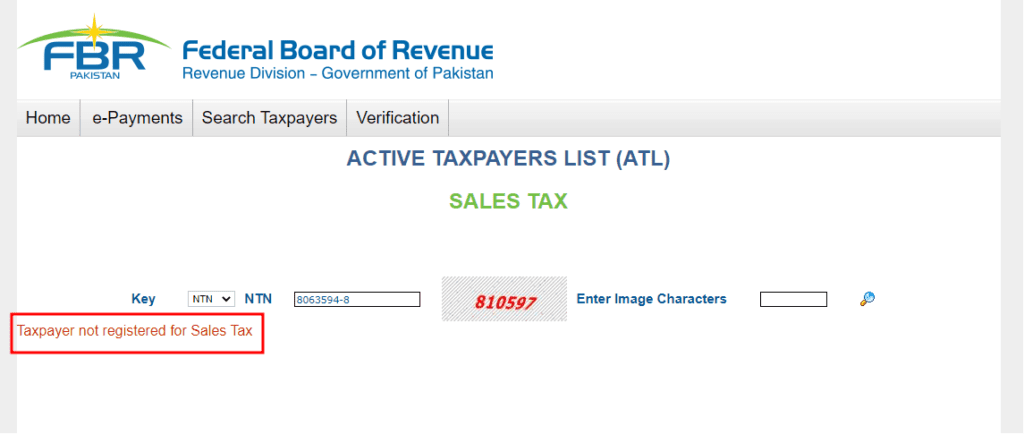

In case, you do not see the information as described above, it means the seller is an unregistered person and he cannot charge you sales tax and further tax.

Moreover, remember that a person who is registered for sales tax but his name appear in sales tax ATL, he is not authorized to charge sales tax from you.

Way Forward

There might be chances that some person provide you sales tax invoice charging sales tax whereas he does not qualify the conditioned imposed by Government. What you can do in such a situation.

First of all, you demand from him an invoice on which sales tax number is printed.

Secondly, you can take a picture of the invoice and send it to FBR at stmonitoring@fbr.gov.pk.

Thirdly, you can report the issue to FBR helpline by calling at 051 111 772 772.

You should take pride in assisting FBR in implementing law and saving fellow consumers from payment of undue sales tax. You may like to share this post with friends to spread the information helping other make informed decision and assist FBR checking the abuse of system by some elements.